Dec 12

preview

TLDR: In his latest commentary, Minneapolis Fed President Neel Kashkari delivers a dose of patience in the Federal Reserve's approach to interest rates.

Kashkari's remarks highlighted his cautious outlook, suggesting that while the labor market shows resilience, the inflation rate, which recently clocked in at 2.7% for March, still overshoots the Fed's comfort zone.

This scenario suggests a possible recalibration of the "neutral rate" upwards, with implications for future monetary policy. The Fed's steady hand since their last rate adjustment in July reflects this uncertainty, influenced by stronger-than-expected inflation figures that forestall any immediate easing of policy.

Investors had initially anticipated up to six rate cuts this year; however, expectations have now tempered to fewer than two.

The ongoing evaluation of economic data, particularly the sticky housing inflation, underscores the complexity of the current economic landscape where a miscalculation in monetary tightening or loosening could steer the economy off its recovery path.

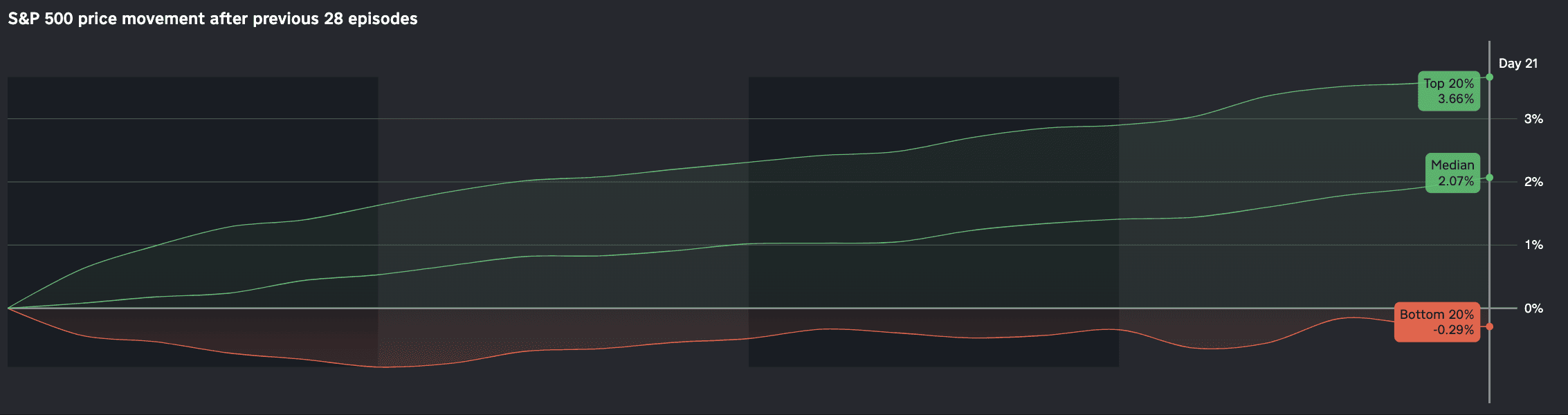

The chart above displays the median 1-month response from the S&P 500, based on data from the past 28 instances where interest rates were held steady for 10 months between 5.25 - 5.50%.

_ Here are the historically best and worst performing S&P sectors on a 1-month basis, based on previous episodes of rates being held between 5.25 - 5.50%:_

Top 3 performing sectors:

Bottom 3 performing sectors:

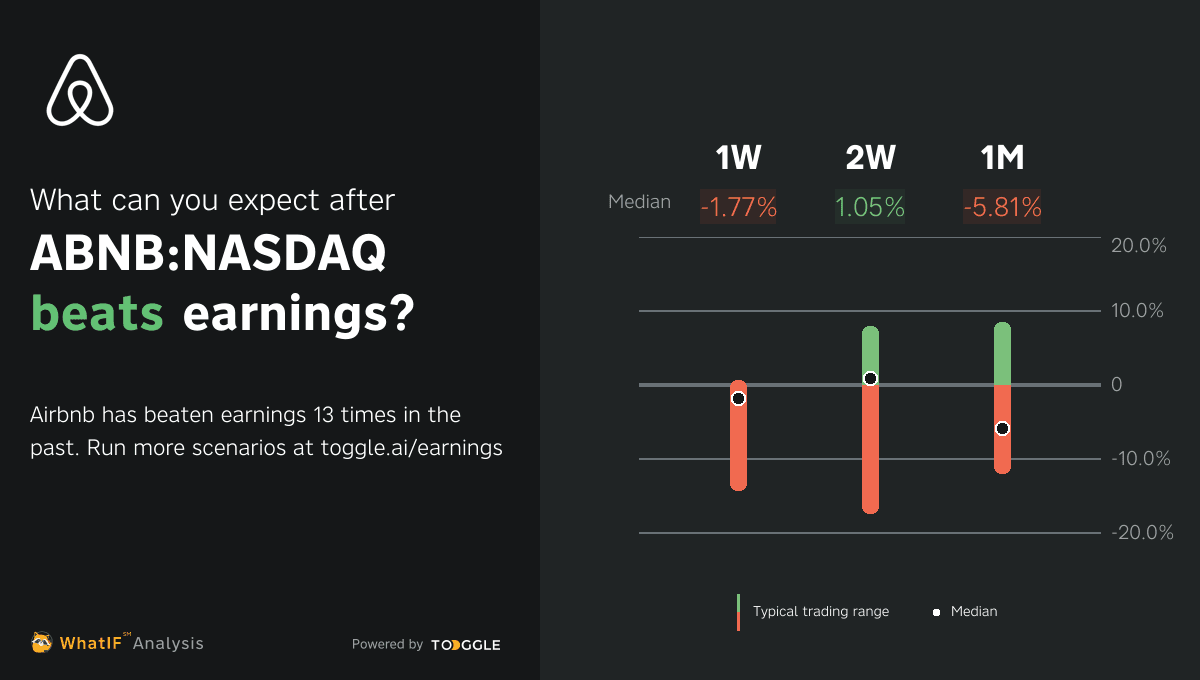

Last quarter, Airbnb managed to surpass revenue expectations with a 16.6% year-on-year increase, achieving $2.22 billion due to robust performance in its 'Nights & Experiences Booked.' However, revenue growth has shown signs of deceleration.

This forthcoming report is predicted to reflect a continued slowdown, with expected revenue growth at 13.4% to $2.06 billion and adjusted earnings projected at $0.23 per share. While Airbnb has consistently outperformed Wall Street’s expectations, it's essential to note that peers such as Expedia and Booking have shown varying results.

Up next

Dec 12

preview