Dec 12

preview

TLDR: The first quarter of the year witnessed an unexpected acceleration in U.S. wage growth, posing new challenges to the Fed’s ongoing efforts to tame inflation.

According to the Labor Department, the employment-cost index rose by a seasonally adjusted 1.2% from the previous quarter, surpassing the 0.9% increase recorded in the fourth quarter and outstripping forecasts of a 1% rise.

Certainly, the increase in wages and benefits is beneficial for employees, but it also heightens concerns at the Fed regarding potentially persistent high inflation.

The latest data triggered a noticeable reaction in the bond market, with yields on 10-year Treasury notes climbing from 4.62% to about 4.67%, and two-year yields rising from 4.98% to 5.02%.

The implications of this hotter-than-expected wage growth are twofold. On one hand, it underscores the bumpy road ahead in bringing inflation down to the Fed’s target of 2%. The consumer-price index, which had soared to around 9% in mid-2022, showed a slowdown to an annual increase of 3.5% this March.

On the other hand, the data arrives at a critical juncture, as Fed officials commence a two-day policy meeting. With the federal funds rate currently held steady at 5.3%, Fed Chair Powell has indicated that the central bank requires more solid evidence of inflation returning to target levels before any rate cuts are enacted.

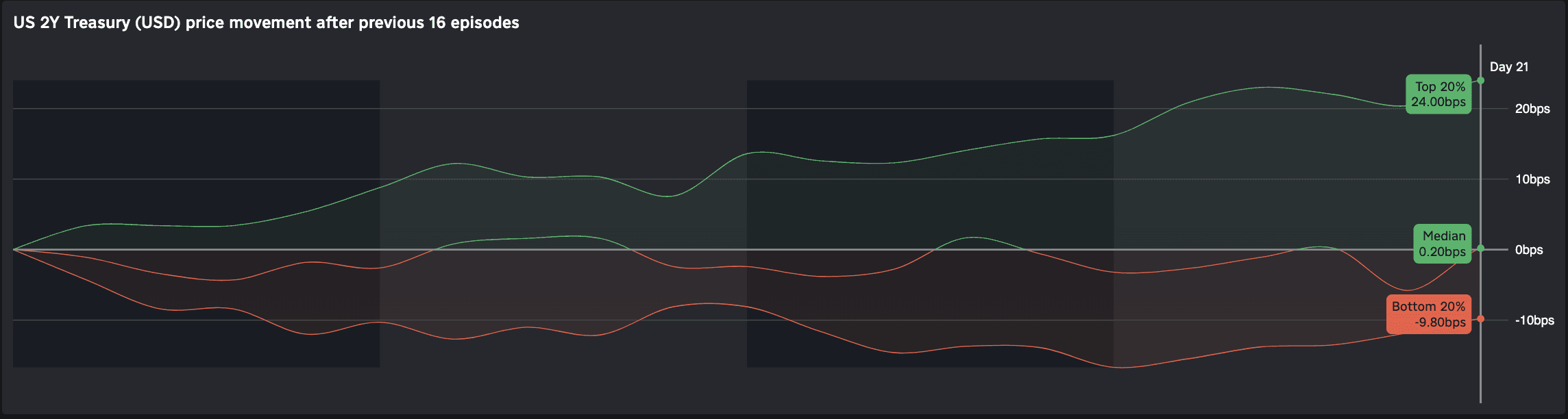

The chart above show the historical 1-month response from the US 2Y Treasury post the past 16 episodes when the 2Y crosses 5%.

Here are the historically best and worst performing US sectors on a 1-month horizon when the 2Y yield is above 5%:

Top 3 Performing Assets:

Bottom 3 Performing Assets:

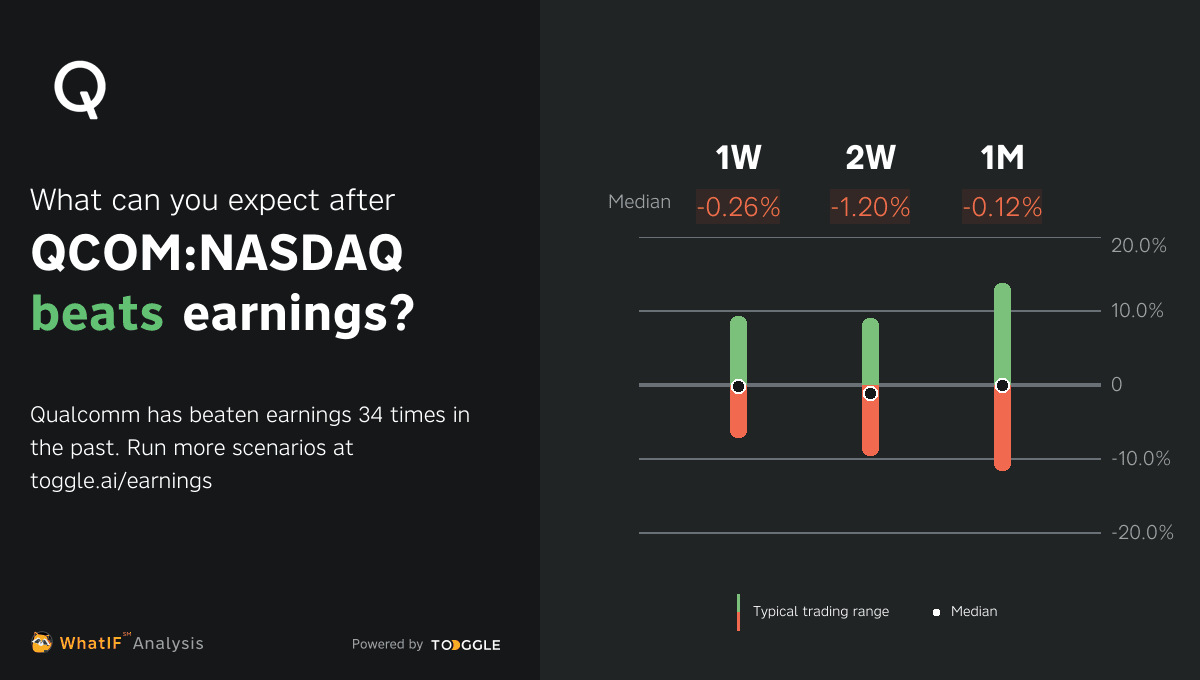

Qualcomm is set to report its Q2 FY24 earnings tonight, with analysts expecting an adjusted profit of $2.32 per share and revenues around $9.34 billion. The company has a history of outperforming estimates, which could continue given its guidance of $2.20 to $2.40 per share in earnings and $8.9 to $9.7 billion in revenue.

Qualcomm's innovation, particularly its new Snapdragon X Plus chip for the AI PC market, underscores its growth potential. Tonight’s results will be crucial for understanding Qualcomm’s market trajectory.

Up next

Dec 12

preview