Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: As Tesla prepares to release its earnings tomorrow, investors are positioning themselves for potentially significant disclosures following a tumultuous period for the EV giant.

The company has faced a series of challenges starting from the beginning of the year, marked by a stark 43% drop in its stock value, reaching its lowest level since January 2023.

Tesla's strategy in recent times has included substantial price cuts across its flagship models and its premium Full Self-Driving (FSD) system.

These moves are seen as an attempt to boost sales and market share amidst softening demand, but they have also fueled investor concerns about profit margins and overall financial health.

The backdrop of these pricing strategies includes a concerning first-quarter performance with weak vehicle deliveries and a high-profile recall of the Cybertruck. Moreover, Tesla announced a significant workforce reduction exceeding 10%, signaling a deeper organizational restructuring.

Financial analysts are bracing for a downturn, with expectations set for a 5.1% drop in revenue. This would mark Tesla's first year-over-year revenue decline since Q2 2020.

By prioritizing the robotaxi project and delaying the Model 2 launch, Tesla might encounter increased growth challenges, particularly as competition intensifies in China and from other original equipment manufacturers. The company's ability to respond to these pressures could be constrained by limited free cash flow.

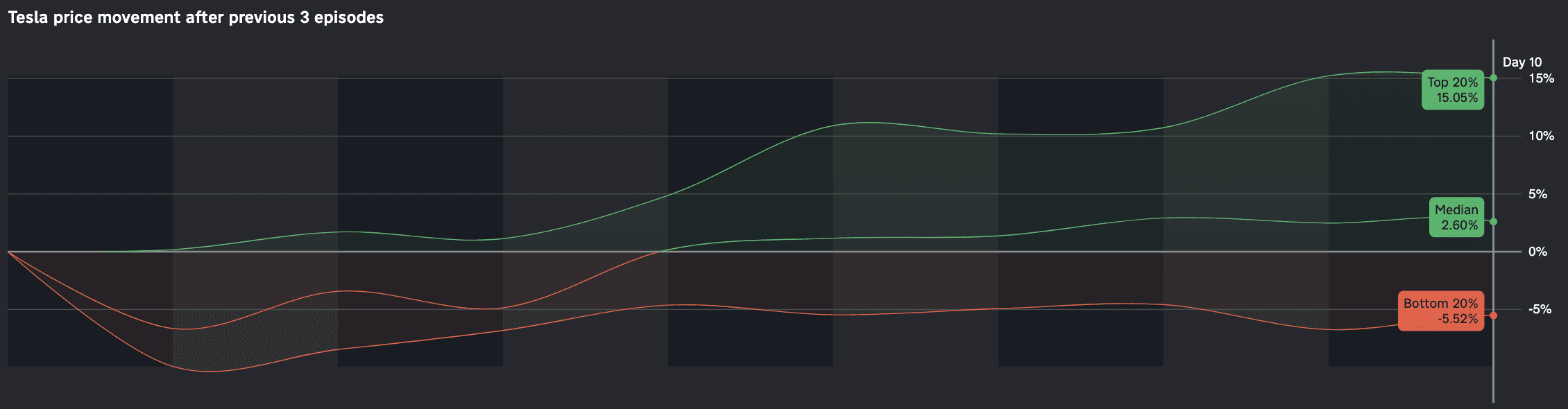

The chart above show the historical 2-week response from Tesla post the past 3 episodes when the company missed revenue estimates and was down 17% in 1 month.

Here is the historical 1-month response when Tesla misses revenue estimates:

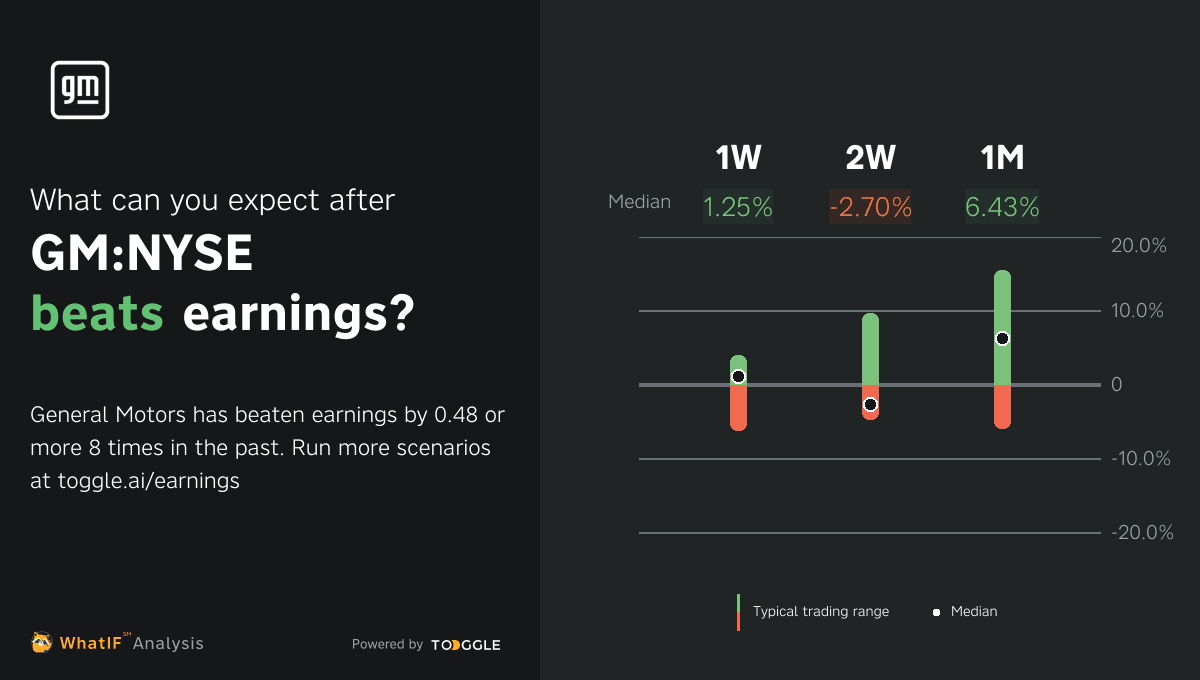

General Motors (GM) delivered strong first-quarter results, exceeding expectations with a revenue of $43.0 billion, up 7% year-over-year, and adjusted earnings per share of $2.62.

The automaker raised its full-year financial outlook, now expecting adjusted EBIT between $12.5 billion and $14.5 billion. CEO Mary Barra highlighted GM's focus on profitability and efficiency as the company expands its electric vehicle (EV) operations, expecting positive EV profits in late 2024.

Up next

Dec 12

preview