Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: Exxon Mobil and Chevron's financial achievements this past quarter are undeniable, akin to striking oil in terms of shareholder rewards, but this has paradoxically failed to spark the enthusiasm one might expect on Wall Street.

These oil titans celebrated monumental profit milestones last year, marking their highest earnings in a decade. Exxon's generous $32 billion return to shareholders, with Chevron not far behind at $26 billion, underscores a significant return of cash flow to investors.

Yet, set against the backdrop of Silicon Valley's luminaries, these accomplishments seem to recede, further amplified by a valuation disparity where oil majors trade at almost 60% lower multiples compared to the S&P 500, deepening beyond their five-year average.

Toggle AI has underscored this anomaly, noting that both Exxon and Chevron's current valuations may signal impending upward trajectories in the coming months.

Facing forward, the road for Exxon and Chevron is laden with hurdles. Amid escalating discussions on energy transition and the unpredictable swings in oil prices, these stalwarts must do more than showcase financial solidity. They're tasked with crafting a narrative that aligns them with the future's green and growth-driven ambitions.

Here is the historical performance of Exxon Mobil's peers on a 1 month and median basis post flat returns in XOM:

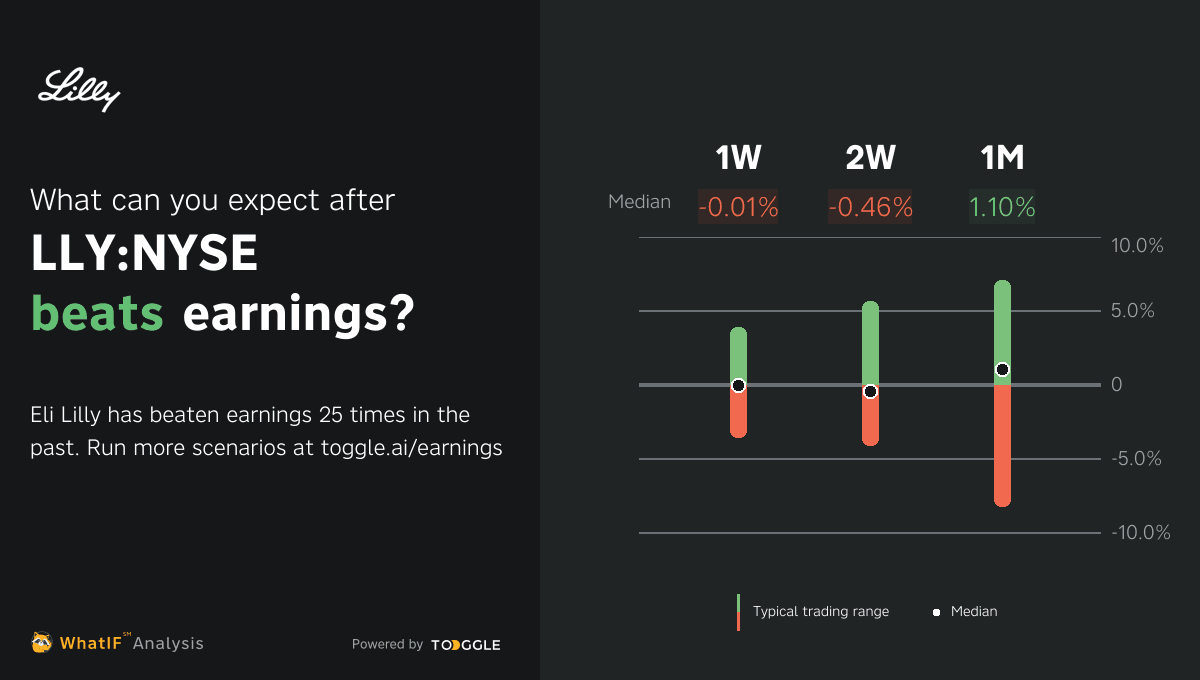

Eli Lilly is expected to report its fourth-quarter earnings tomorrow before the market opens, with anticipation surrounding the performance of its key drugs, especially in the diabetes and obesity treatment sectors.

Analysts are particularly focused on the sales numbers of Lilly’s FDA-approved tirzepatide medicines, Mounjaro and Zepbound, the latter being a newly launched weight loss medicine approved in November 2023.

Discover how other companies could react post earnings with the help of TOGGLE's WhatIF Earnings tool.

In past 17 instances where Nike's stock experienced similar downturns, analysis by Toggle suggested a trend of median positive movement in the stock price over the subsequent three months.

Recently, Nike's shares were impacted negatively following the release of Adidas's results, which pointed to potential difficulties in the global athletic wear market, indicating broader sector challenges that could affect Nike.

Up next

Dec 12

preview