Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: Oil prices are on a rising trajectory, recently witnessing a notable uptick, driven by a confluence of factors.

First, a considerable drawdown in U.S. crude inventories has been a key price driver. The Energy Information Administration reported a significant drop of 9.2 million barrels in U.S. crude stocks, far exceeding analysts' predictions. This decrease, coupled with a slump in U.S. crude output due to extreme weather conditions, has put upward pressure on oil prices.

Secondly, China's recent economic maneuvers are impacting the oil market. The People's Bank of China's decision to inject approximately $140 billion into their banking system, by lowering banks' reserve requirements, is anticipated to stimulate economic activity, subsequently raising oil demand.

Lastly, escalating geopolitical tensions, particularly in the Middle East, are adding layers of complexity and uncertainty. Recent incidents, including the killing of three US service members and attacks on a vessel carrying Russian oil, have heightened concerns about potential disruptions in oil supply.

Approximately 3 million barrels of Russian oil pass through these waters daily, heading to Asian markets. The reaction of owners linked to Russian cargoes in the face of these tensions remains a critical factor to watch, as it could significantly impact oil flow and prices.

Here are the historically best and worst performing SPX stocks on a median basis post crude futures rising 12% over a month:

The top 3 performing stocks:

The bottom 3 performing stocks:

The focus for Microsoft's earnings is the company's Intelligent Cloud segment, especially the performance of Azure, with total revenues expected to be around $61 billion.

The company has consistently beaten earnings estimates in the past four quarters, with the average surprise being 7.83%. Investors are also keenly watching Microsoft’s advancements in AI and the impact of its increased capital expenditures, which have climbed significantly since last year.

Discover how other companies could react post earnings with the help of TOGGLE's WhatIF Earnings tool.

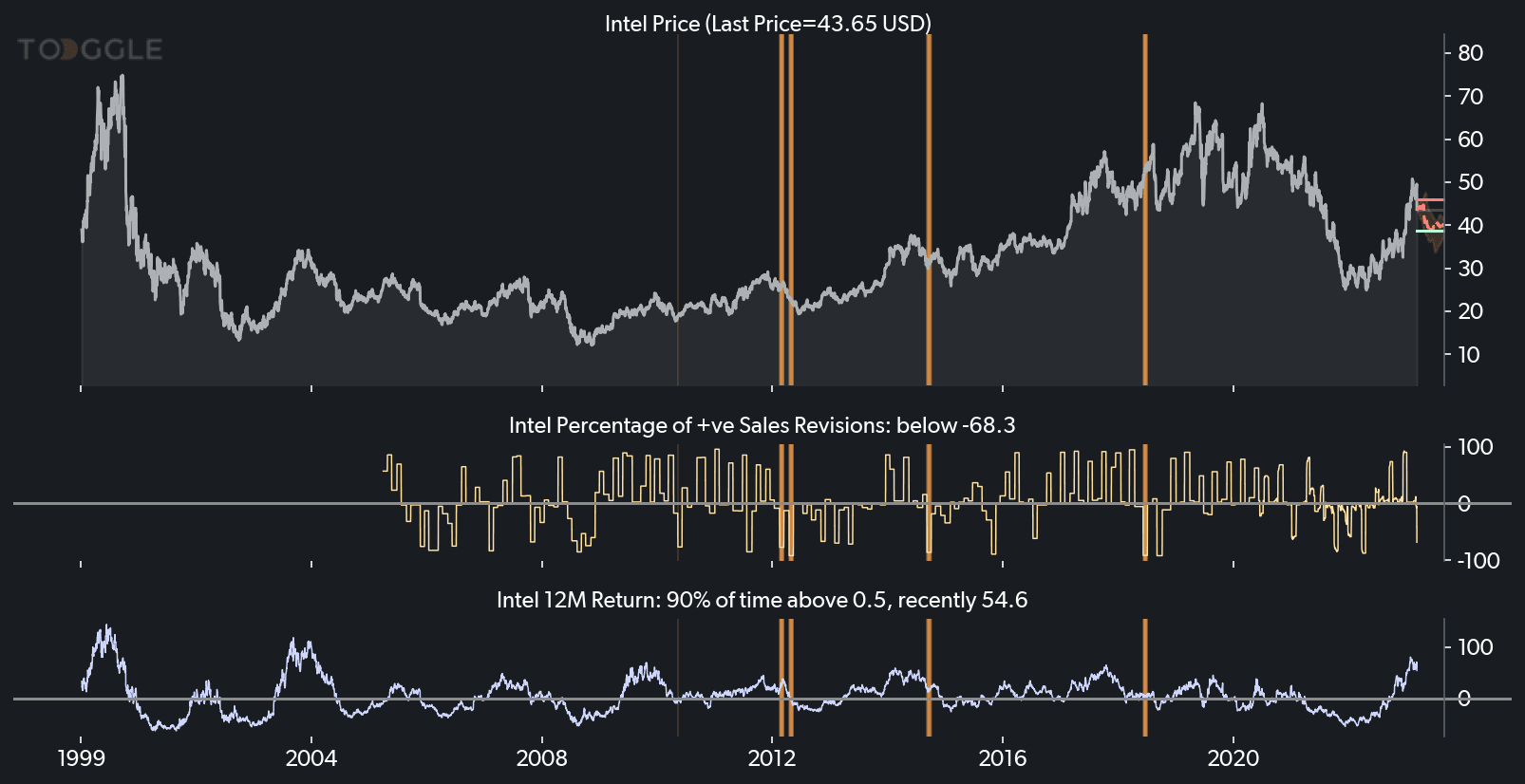

Toggle examined 5 comparable instances in the past where analyst revisions for Intel fell while 12M return was positive. Historically, this has often been followed by a decrease in the stock's price over the next six months.

While Intel's recent financial results exceeded expectations, its forecast for early 2024 indicated lower than expected revenue and earnings. This, coupled with challenges in AI and chip manufacturing, has led to investor concerns.

Up next

Dec 12

preview