Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: As the S&P 500 logs its best three-day rally of the year, eyes are turning East where China's markets are catching a similar tailwind.

The Hang Seng Index notched up a 10th consecutive day of gains on Monday, a sweet 0.55% increase. Over in mainland China, the Shanghai Composite climbed by a buoyant 1.16%, and the Shenzhen Composite jumped a whopping 2.07%.

This rally comes amidst ongoing economic challenges, particularly in the housing sector which remains sluggish despite governmental efforts. Yet, investors seem to be drawing confidence from broader economic indicators showing resilience across other sectors.

China’s economy surprisingly grew by 5.3% in the first quarter of the year, edging past expectations and fuelling hopes that Beijing’s ambitious annual growth target of around 5% might actually be within reach. Manufacturing is on a six-month winning streak, with the fastest growth since early 2023, and service sectors continue to expand robustly.

Chinese stocks are still trading at a steep discount compared to their global counterparts, with the Shanghai Composite's P/E ratio significantly lower than that of the S&P 500. However, improving market breadth and recent policy announcements aimed at supporting the economy and enhancing market liquidity are helping buoy investor sentiment.

Though geopolitical tensions linger and economic risks remain, the fear of missing out (FOMO) is palpable. Investors are gradually warming up to the momentum, suggesting that the rally in Chinese equities might still have legs.

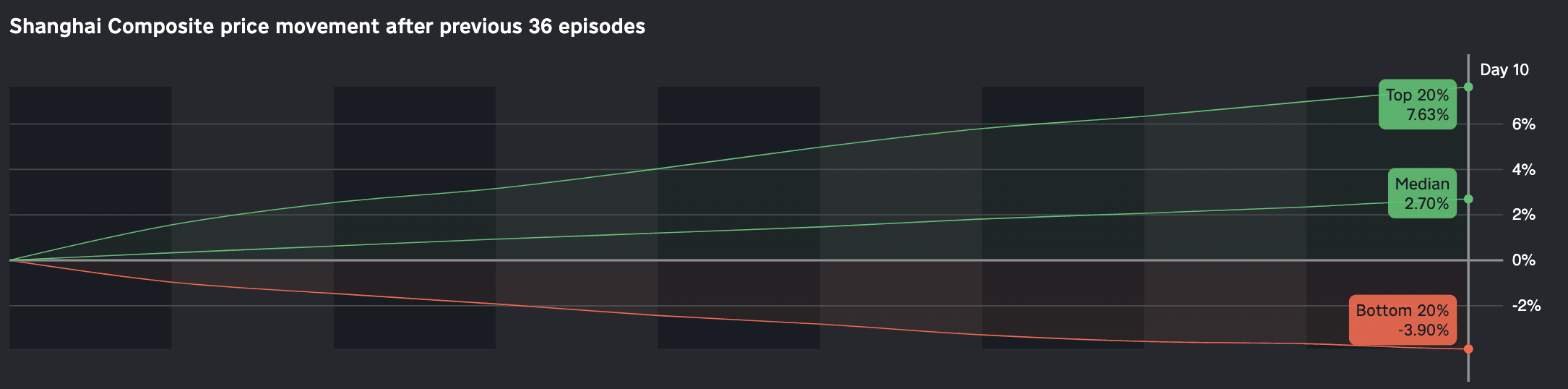

The chart above displays the median 2-week response from the Shanghai Composite, based on data from the past 36 instances where the index rose 16% in 3 months and was trading below 3150.

Here is the median 1-month performance of Chinese ADRs, based on previous rallies in the Shanghai Composite:

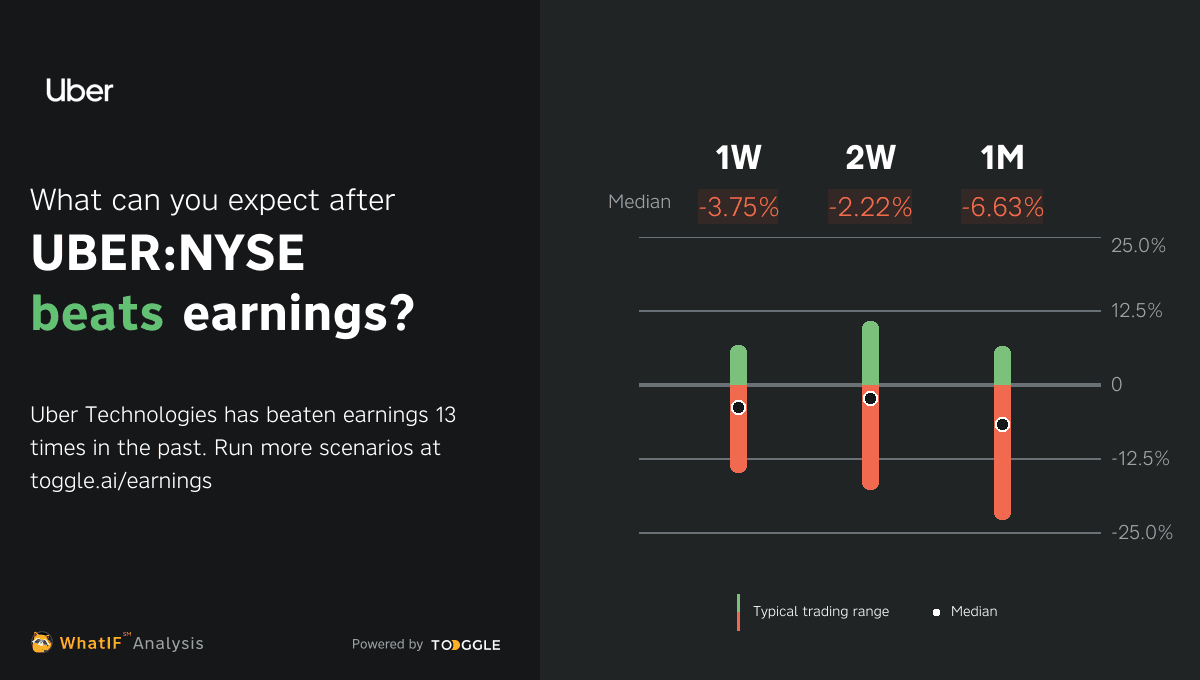

Wall Street expects Uber to post an EPS of $0.21, marking a significant 362% year-over-year increase, with revenue projected at $10.08 billion, up 14% from the same quarter last year.

This follows Uber's milestone of posting its first annual operating profit in 2023. The anticipated results reflect strong demand for ride-sharing and deliveries, alongside growth in its nascent advertising business.

Up next

Dec 12

preview