Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: As tensions escalate, U.S. investors have ramped up their defensive strategies, reflected in a notable rise in premiums paid to secure portfolios against potential market upheavals.

This week, the Wall Street fear gauge, the Vix index, surged to a six-month high of 19.6, signaling a sharp increase in market anxiety. Since late March, when it was at a low of 12.6 percent, the Vix has risen significantly, reflecting a similar sentiment in the S&P 500, which dropped nearly 5% this month alone.

Factors such as geopolitical instability, rising interest rates, the Federal Reserve's hawkish stance, and ongoing inflation concerns have temporarily tipped the scales in favor of the bears.

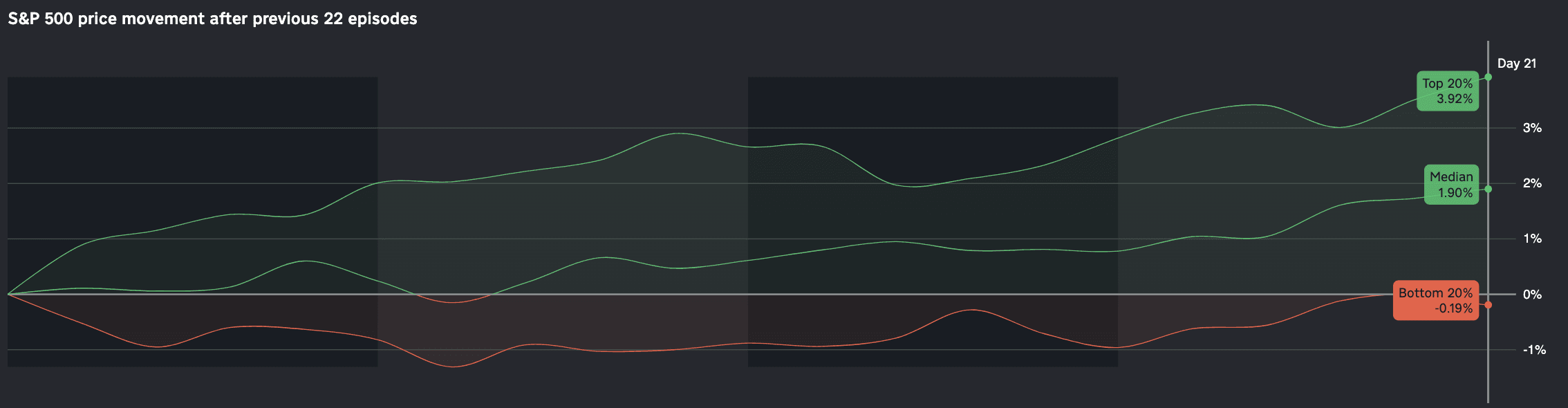

Meanwhile, the equity risk premium (ERP) for the S&P 500, which measures the expected return difference between equities and bonds, has fallen into negative territory for the first time since the early 2000s.

While a lower ERP isn't necessarily bad for stocks, its impact varies with the economic cycle. It could indicate potential for future corporate profit growth, but also raises concerns about the possibility of a market bubble.

The chart above shows the historical 1 month response from the SPX based on the past 22 instances when the index's equity risk premium crossed below 0.

Here are the historically best and worst performing US sectors on a 1 month horizon:

Top 3 Performing Sectors:

Bottom 3 Performing Sectors:

NVIDIA's shares fell 3.9% on Wednesday amid broader struggles in the semiconductor sector. This downturn followed ASML Holding's announcement that its first-quarter orders had not met expectations.

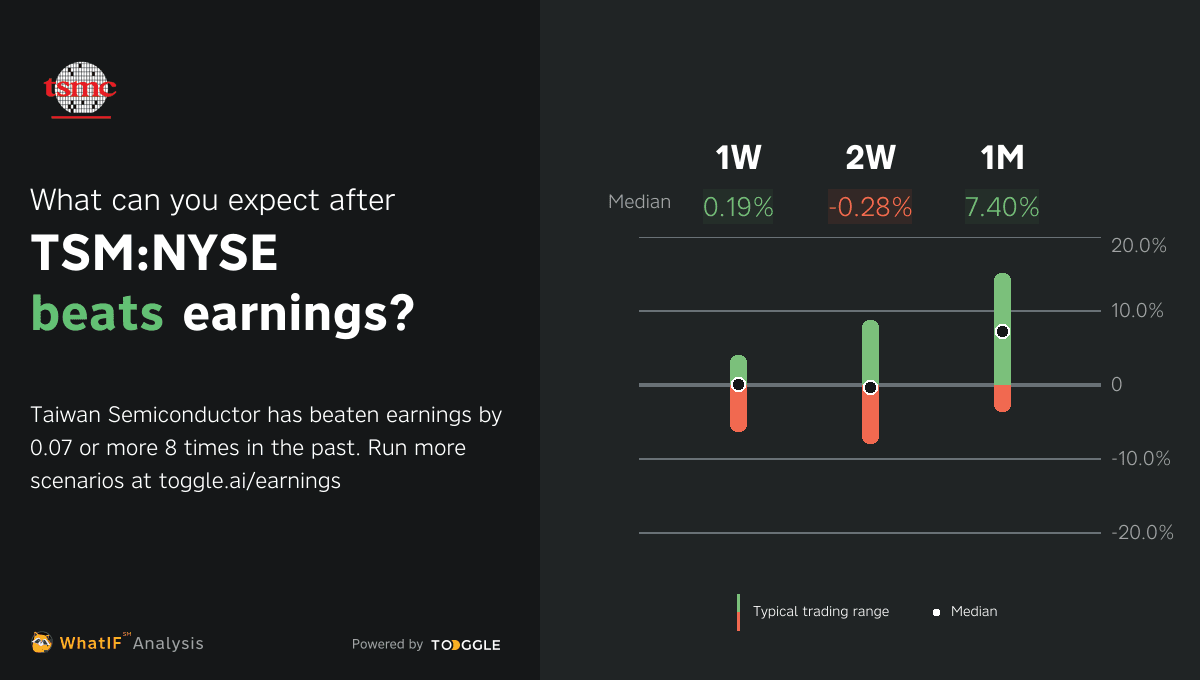

However, there was more positive news from Taiwan Semiconductor Manufacturing, the world's leading contract chip maker and a significant supplier for NVIDIA. TSMC reported on Thursday that its first-quarter revenue had been bolstered by strong demand for AI chips.

Up next

Dec 12

preview