Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: In the latest financial revelation, the CPI for February 2024 emerged at 3.2% year-over-year, surpassing both the previous and forecasted figures of 3.1%.

This uptick marks a subtle yet significant shift in consumer price movements, potentially indicating a nuanced landscape of inflationary pressures within the economy.

The breakdown of the CPI data unveils diverse trajectories across sectors. Shelter, a major component, surged by 5.7% over the past year, underlining the housing market's significant contribution to inflationary trends. On the flip side, energy commodities experienced a decline of 4.2%, suggesting a release valve in the inflationary pressure from this segment.

Notably, the services less energy services category saw a notable increase, with a 5.2% rise over the last year, hinting at underlying strength in service-based inflation. Amidst these figures, certain sectors like medical care services (+1.1%) and transportation services (+9.9%) highlight the variegated nature of price changes affecting the consumer basket.

Such a nuanced CPI report not only serves as a barometer for inflation but also as a guidepost for potential policy adjustments and market expectations. As investors and analysts dissect these numbers, the overarching narrative seems to be one of cautious observation, gauging the potential ripple effects on monetary policy and market dynamics.

Here are the historically best and worst performing sectors when 10Y yields jump 5 bps in 1 day:

The top 3 performing assets:

The bottom 3 performing assets:

In the last 8 occasions where XLE was at a high, Toggle's analysis showed a median downward movement in the ETF over the subsequent 6 months.

The U.S. Energy Information Administration forecasts that the Brent crude oil spot price will average $95 per barrel in 2024, up from $84.09 in 2023, which is expected to benefit the energy sector and, by extension, XLE

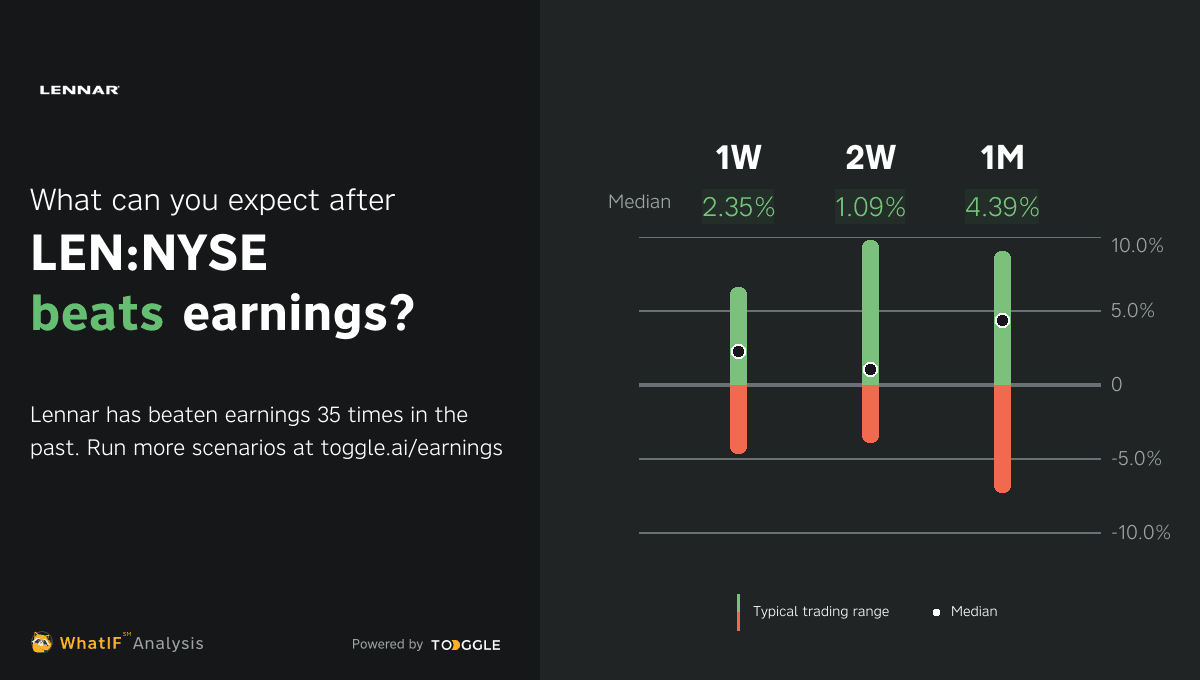

Analysts are projecting an EPS of $2.20 for the quarter, an increase from the EPS of $2.06 reported in the same quarter of the previous year. Revenue forecasts for Q1 2024 are set at $7.4 billion, a significant increase from $6.5 billion in the corresponding period a year ago.

These figures reflect a continuation of Lennar's strategic focus on driving volume and production to meet demand, despite the challenges posed by higher interest rates affecting homebuyer affordability

Discover how other companies could react post earnings with the help of TOGGLE's WhatIF Earnings tool.

Up next

Dec 12

preview