Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: Friday's inflation data presented a complex scenario for the U.S. economy and the Federal Reserve's monetary policy, showing that the fight against inflation is still ongoing.

According to the March report, U.S. inflation rose to 2.7%, surpassing expectations of a 2.6% increase and highlighting sustained price pressures. This uptick, driven largely by increased petrol costs and notably "sticky" service sector costs like shelter, comes at a precarious time as the Federal Reserve grapples with decisions on interest rates.

The data, revealed that core PCE, which excludes volatile items like food and fuel, held steady at 2.8%. This stability in core inflation, contrary to anticipated decreases, suggests an underlying resilience in inflationary pressures, despite broader economic efforts to cool them.

Market reactions were notably mixed. Equity markets saw a rebound with the S&P 500 and Nasdaq Composite climbing, driven by significant gains in tech stocks like Alphabet. However, moves in the bond market were more subdued, with yields on two-year and ten-year government bonds showing minimal changes.

This inflation report complicates the Fed's plan to potentially lower interest rates this year, especially in light of the slow economic growth recorded in the first quarter. Futures traders have now adjusted their expectations, fully pricing in the possibility of a rate cut only by the Fed's November meeting, just after the U.S. presidential election.

The chart above show the historical 1-month response from the SPX post the past 20 episodes when the US 10Y YTM crossed above 4.7%.

Here are the historically best and worst performing sectors on a 1-month horizon, when 10Y yields cross 4.7%:

Best performing assets: S&P Oil & Gas Exploration & Production: 5.12% S&P Materials: 2.98% S&P Retail: 2.25%

Worst performing assets: S&P Banks Select Industry Index: -0.81% S&P Health Care: -0.28% S&P Consumer Staples: -0.11%

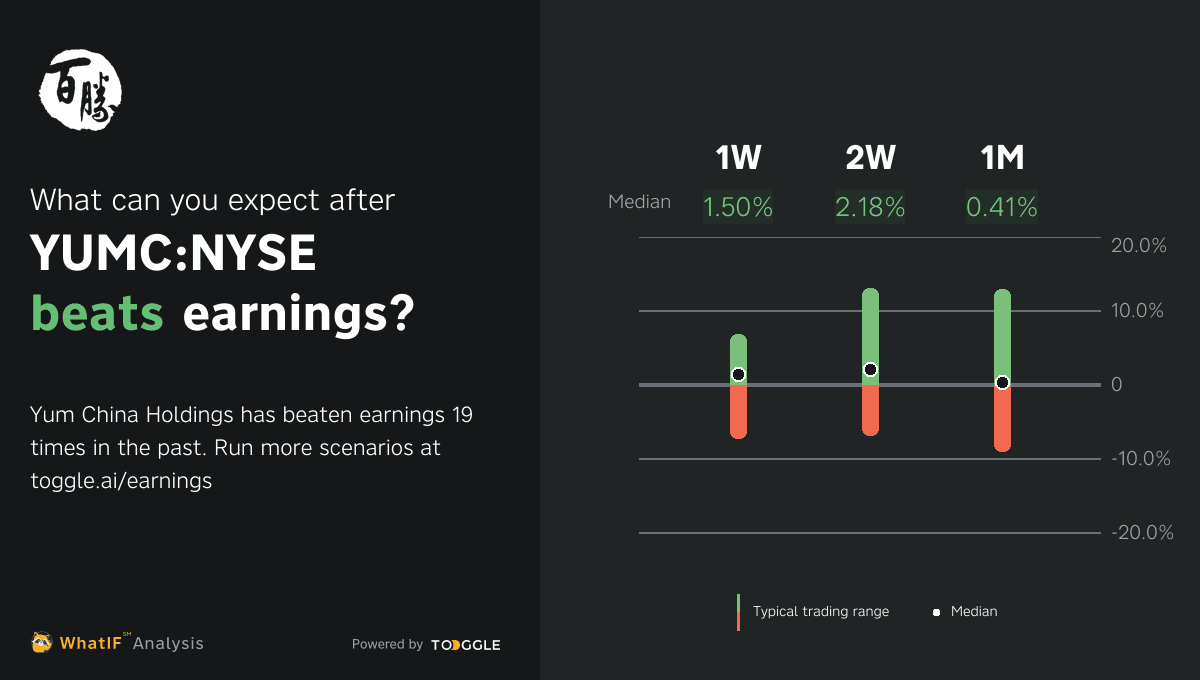

Last quarter, Yum China exceeded expectations, reporting a revenue increase of 19.4% year-over-year, and surpassing analysts' forecasts by 7%. However, expectations for this quarter are more modest, with projected revenue growth slowing to 4.3% year-over-year, reaching an estimated $3.04 billion. The anticipated adjusted earnings per share are set at $0.65.

These figures come at a time when the broader market faces mixed signals and volatility, affecting the restaurant sector as a whole. Yum China is heading into earnings with an average analyst price target of $56.1 (compared to share price of $39.91).

Up next

Dec 12

preview