Dec 12

preview

Toggle AI is now Reflexivity! Click here to go to our new website

TLDR: US Treasury yields propelled to new peaks for 2024 after Chairman Powell's latest remarks cooled expectations for any near-term easing of interest rates.

Powell highlighted that the Fed would likely maintain its current restrictive monetary policy longer than previously anticipated, in order to combat persistent inflationary pressures.

This has marked a notable pivot in his rhetoric, especially following three consecutive months where inflation metrics have surpassed analyst forecasts. The two-year yield briefly surged to 5%, while the 10-year yield climbed seven basis points to 4.67%.

The bond market's reaction, however, might be an overestimation of the inflation outlook's worsening, according to Neil Dutta at Renaissance Macro Research. Dutta suggests that just as negative inflation data influenced the Fed's recent rhetoric, a positive turn could similarly sway future decisions.

Yet, not all is bleak according to James Demmert at Main Street Research, who argues that rising bond yields reflect a strong global economy and robust corporate earnings. He maintains a bullish stance on stocks, emphasizing that in the early stages of a business cycle, earnings growth is a more critical driver than Federal Reserve policies.

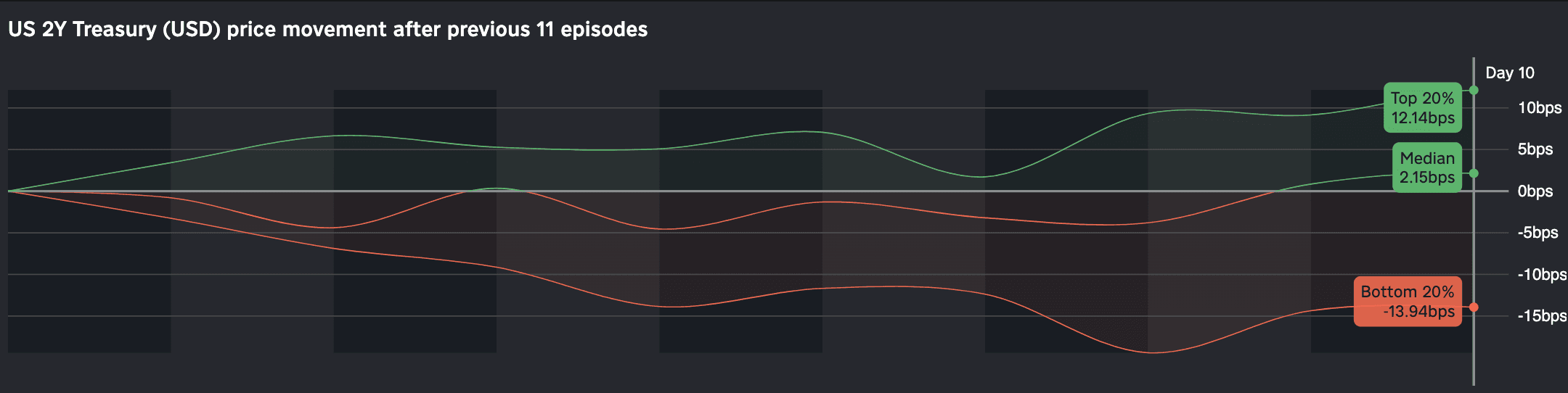

The chart above displays the historical two-week response from the US 2Y based on the past 11 instances when the US 2Y yield crossed above 5.2%.

Here are the historically best and worst performing US sectors on a 1 month horizon:

Top 3 Performing Assets:

Bottom 3 Performing Assets:

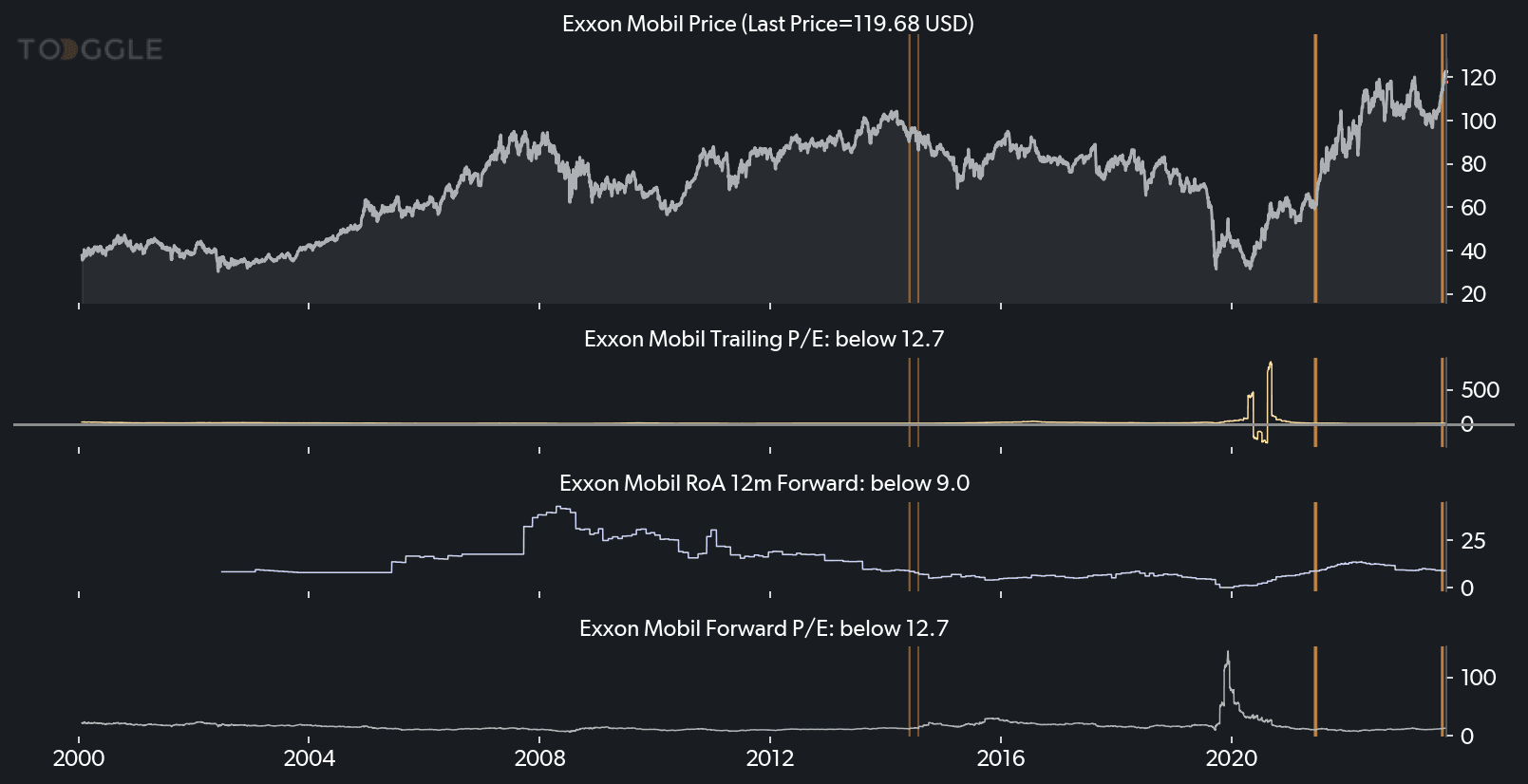

In the past 4 occasions when Exxon Mobil's valuation indicators were low, Toggle's analysis showed that the stock typically demonstrated a median increase over the subsequent week.

The oil giant is set to announce its earnings on April 26. Historically, the stock tends to rise, particularly if the company exceeds revenue forecasts.

Up next

Dec 12

preview