Contango vs. Backwardation

Commodity speculators and hedgers are always watching the shape of the futures curve - specifically if the futures markets are in contango or backwardation. These refer to the pattern of prices over time, specifically if the price of a contract is rising or falling, but many times these two curves are confused for one another.

When a market is in contango, the forward price of the futures contract is higher than the current spot price. On the other hand, when a market is in backwardation, the forward price of the futures contract is lower than the spot price. Over time, as the futures contract reaches maturity/delivery, the futures price will match the current spot price.

Contango

When the price of a futures contract is higher in the future, than its current price, this creates an upward sloping forward curve. This means that futures contracts are currently trading at a premium relative to the spot price. This can occur with physically delivered futures contracts because of factors like storage, cost to carry and insurance. However, this can change over time as market participants reevaluate the future expected price.

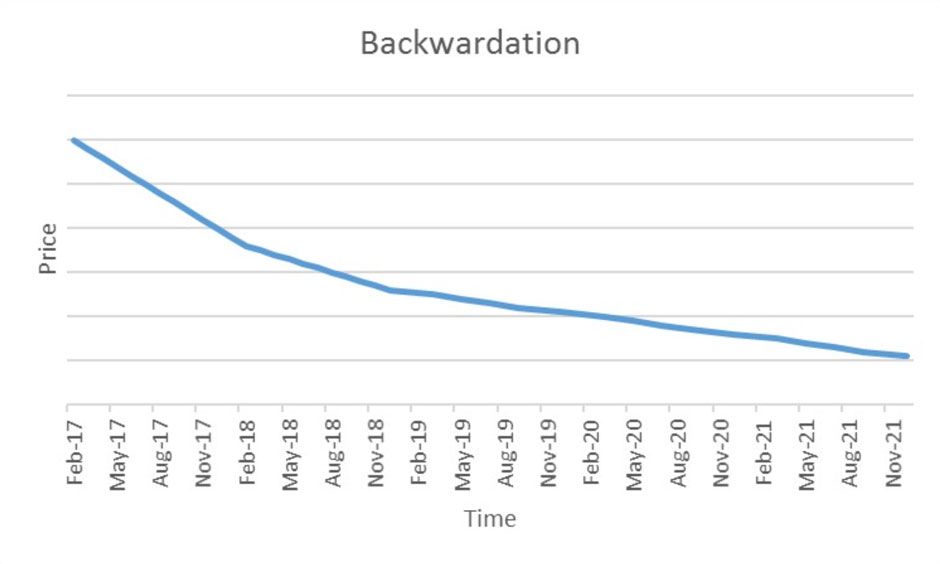

Backwardation

If the price of a futures contract is higher today than its future price, this creates a downward sloping forward curve or inverted curve. This can also occur with physically delivered futures contracts because there may be a benefit to owning the physical material today. This is known as the convenience yield and it is inversely related to inventory levels. As a result, when inventory levels are low, the convenience yield is high and vice versa.