Equity Risk Premium

The ERP measures the excess return granted for owning a stock, when compared to a risk-free asset like a government bond.

The ERP is a measure of cross-asset valuation. It tells you if equities are cheap relative to bonds. High means value, low means cheap.

The ERP is a cross-asset valuation measure comparing the return available for equities with that available for bonds. It applies to single stocks and by extension to equity indexes, and works well for most industries with some relevant exceptions.

The ratio is calculated as the ratio between the share price and the earnings per share. The latter can be trailing earnings or forward earnings.

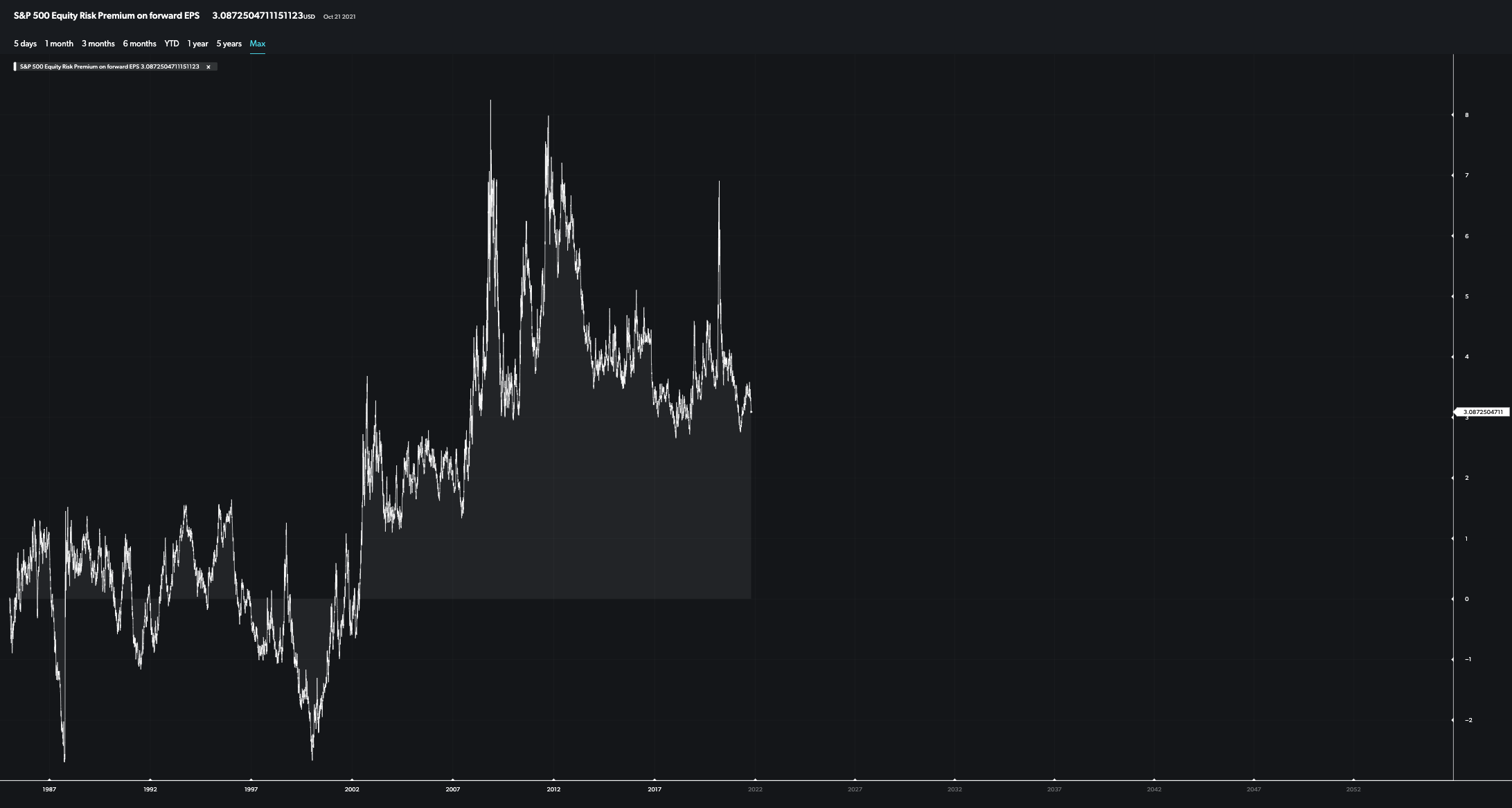

The chart below shows the trailing PE for SPX in the last 40 years.

Remembering that “low = expensive” you can see that during the 80s and 90s, all the way up to the dot.com bubble, the market was expensive if compared to bonds. For context, this was a period of high PE ratios combined with very attractive Treasury yields in the 6-8% range on the 10y bond. Conversely, the picture shifted in favour of Equities in the age of Quantitative Easing. During the period from 2011 onwards, equities have become meaningfully cheaper than bonds.