Reflexivity Insights vs Trading Signals

A question frequently asked by users is “are Reflexivity insights trading signals and if not, why?”

The answer to the first question is simple: no, Reflexivity insights are not trading signals.

A trading signal can be thought of as a recommendation that can be “blindly” followed since it takes into account all factors driving price action. On the other hand, Reflexivity insights are solely generated based on looking at historical data and does not account for externalities which have not previously been observed.

Whenever Reflexivity detects a change in a financial driver (micro or macro), it backtests the identified relationship to assess its consistency and robustness. If the tests prove to be significant, an insight is then generated. The insight then comes to life when human (user) and machine (Reflexivity) work together.

Take the Russian invasion of Ukraine coupled with the global recession, since events of this scale have not been simultaneously observed before, a lot of insights failed. Specifically, any insights suggesting upside failed because markets were purely driven by macro events and given a potential world war, markets were going down. In this case, using the insight as a signal would have led to your portfolio losing (even more) money.

However, had you used insights as perspective, you would notice that all bullish insights are failing, no matter the driver. Hence it might be a good idea to sit out of the market.

Essentially, insights are best used when the user supplements them with real time information like company fundamentals, competitor analysis and the macro picture.

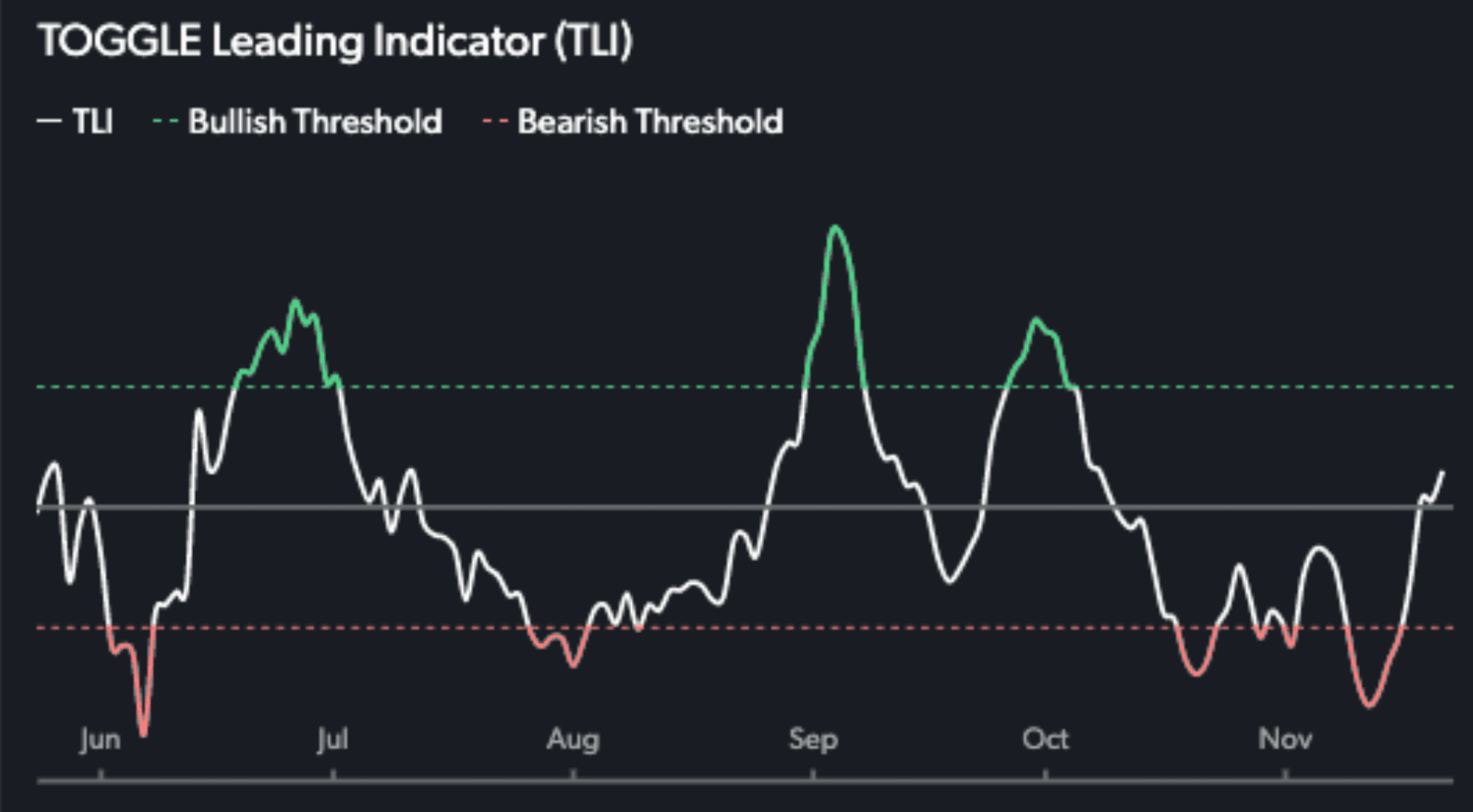

For example, the TLI (an aggregation of insights across 5000 US stocks) has been suggesting potential downside over the last few weeks. This can be seen on the graph below, specifically the red lines.

Had you used this as a signal, you would have probably sold your position in US stocks the first time the indicator dipped into bearish territory. However, since the indicator is generated based on looking at historical data, it did not take into account real time information. Factors such as a cooler CPI and PPI release, strong earnings from a variety of companies and continued strength on the consumer side - all positive news for the market.

Therefore, had you sold your positions, you would have lost out on the rally and upside observed over the last few weeks.

The insight you can get out of this is that - get your stop losses ready because downside COULD be around the corner.

Reflexivity insights help give you another perspective into potential market price action. It's then up to you to evaluate whether the perspective is valid and if not, why is it not valid. Answering questions like these can help you make more informed decisions, taking into account the entire picture, reducing your risk.

Lastly, in the scenario where Reflexivity generates a bullish insight and a bearish insight for the same stock simultaneously, your input is necessary. Especially because insights are mutually exclusive, they are not dependent on each other. Firstly, analyse the differences between the 2 insights: number of stars, historical occurrences, backtesting returns. Through this process you should be able to decipher which insight has more weighting.

Then you can supplement the insights with other information - what are other tools saying, what’s happening in the news, how has the sector historically performed.

All in all, Reflexivity is there to assist you in your investing decisions, not tell you what to do. That’s why we called it Copilot, not autopilot.