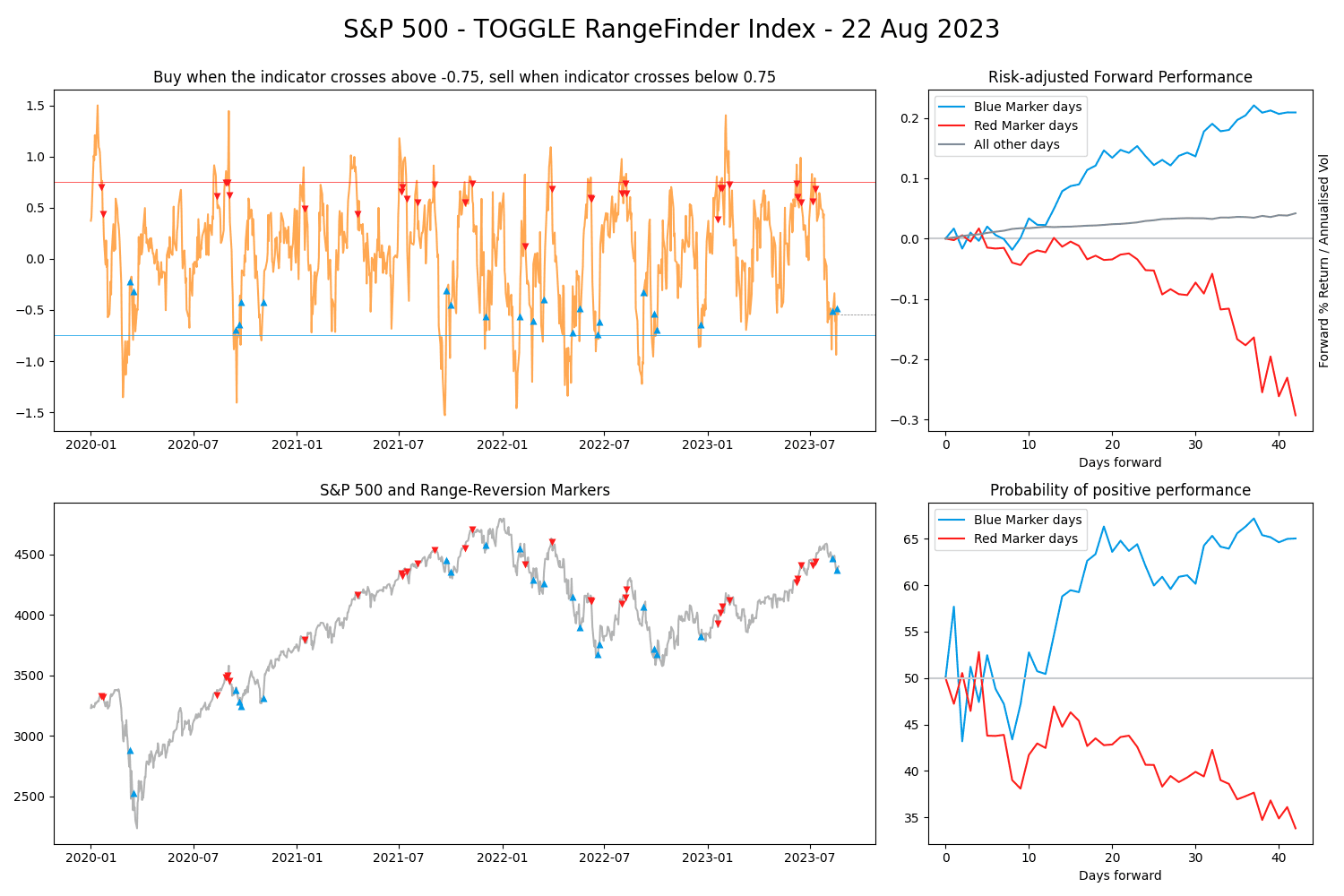

Rangefinder Index

Last updated August 22 2023

Introducing the Rangefinder, an indicator which gauges the likelihood of S&P 500 reverting within its recent price range.

When traders speak about the range, they generally refer to the recent range that the security has explored in the recent past.

The RLI is used on the basis of an empirical crossover rule: when the indicator crosses below -0.75 the reversion is upwards, and vice-versa when the indicator crosses above 0.75 the correction is downwards.

For blue marker days, we observed that returns rise as time goes on, with 20 days and 40 days forward as the ideal holding periods. For red marker days, the same was observed, but 10, 25 and 40 days forward had the highest probability of positive returns on a short position.

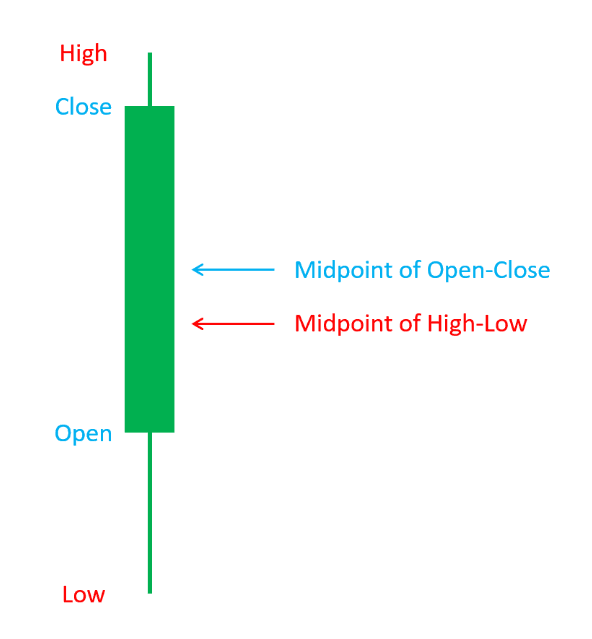

The Rangefinder is calculated by comparing the midpoint of the high-low bars with the midpoint of the open-close bar. The intuition behind this is that, as markets begin to invert a trend, the peaks and lows of the day tend to move in the future direction earlier on.

The index is best used as a compliment to your strategy rather than the sole indicator. For example, a Reflexivitist can use the Rangefinder with the TLI, as well as individual insights and observing macro news. We always recommend users supplement Reflexivity insights with more research in order to make confident and informed decisions.